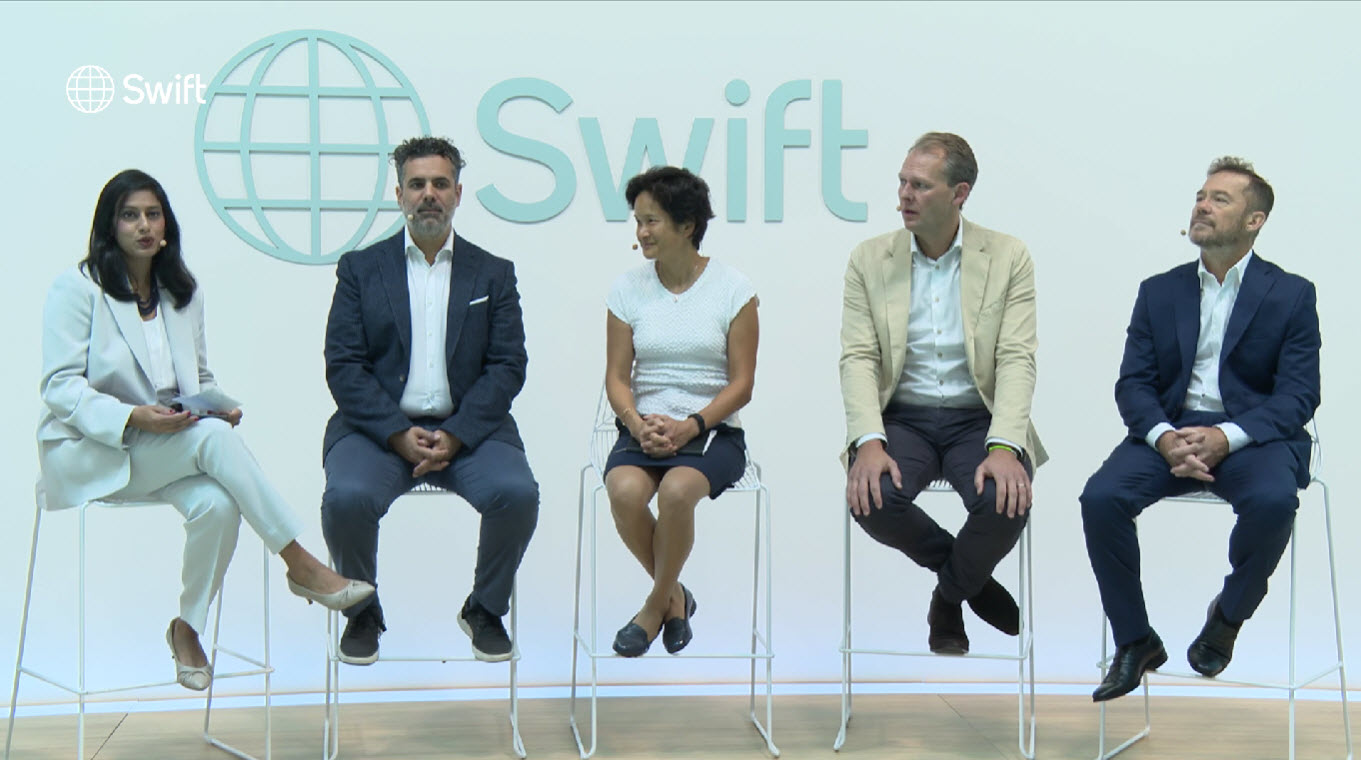

Live from Sibos: Sailing towards interoperability: the digital transformation of global trade

At Sibos, the global financial services networking event, the panel deliberated on the UK Electronic Commercial Documents Act and the pathway toward complete adoption of the electronic bill of lading (#eBL).

Our CEO, Alejandro Pernías, actively contributed to the expert panel, delving into the pivotal role of #eBL in the digital transformation of commercial execution in global trade.

The urgency for immediate action was a resounding theme among the panel participants. Digitalization, the establishment of interoperable systems, and the adoption of standards were underscored as imperative steps for enhancing connectivity and data transmission. It is crucial to echo these discussions on standardization, digitization, and interoperability to elucidate the essential requisites for success to stakeholders across industries. The time to embrace these transformations is now.

During the panel session, challenges related to the limited adoption of electronic Bills of Lading (eBLs) were highlighted. This aligns with the findings of a survey conducted by the Future International Trade (FIT) Alliance, which comprises BIMCO, DCSA, FIATA, ICC, and SWIFT. According to the survey, a majority (63%) of respondents identified a lack of stakeholder readiness as a significant barrier to the adoption or increased use of eBLs. This obstacle ranked second only to concerns about technology, platform, or interoperability issues.

To address these challenges, embracing standardization as the foundational principle for digitization is crucial. This approach enables supply chain stakeholders to achieve interoperability, eliminating the need for uniform adoption of specific technologies or platforms. Interoperability ensures that data can be seamlessly shared, transcending system boundaries.

Currently, many global trades finance banks possess the capability to process eBLs, having obtained licenses from various eBL solution providers. However, without interoperability, all parties involved in a transaction must be using the same eBL system to transmit these documents. Interoperable eBL solution providers facilitate the smooth transmission of eBLs between different platforms. This means that each party in the transaction only requires a single license, simplifying adoption and taking it to the next level of efficiency and convenience.

The financial industry and the trade eco-system seem to be ready for innovation through collaboration for improved efficiency, global connectivity, true sustainability and an overall improved customer experience.

Click on the following link to learn more about edoxOnline.

Follow us on LinkedIn

November, 2024.

Our online Demo takes 30 minutes and provides an overview of edoxOnline main features, functionality and the benefits of digital collaboration.